Transform Your SaaS Business with Flexible Financing Options: Exploring B2B BNPL and Non-Dilutive Funding

As the SaaS industry continues to grow and evolve, innovative financing options are becoming increasingly essential for companies looking to scale and remain competitive. Traditional funding methods, such as venture capital, often come with the drawback of diluting ownership. However, new approaches like Buy Now, Pay Later (BNPL) for B2B transactions and other non-dilutive funding solutions offer compelling alternatives. In this article, we will explore the benefits of B2B BNPL, SaaS payment flexibility, and non-dilutive funding options that can help your SaaS business thrive.

The Importance of SaaS Financing

Securing adequate financing is crucial for SaaS companies to develop new features, enhance customer acquisition, and scale operations. However, traditional financing routes, such as equity funding, often require giving up a portion of ownership and control. This is where non-dilutive funding options come into play, providing the necessary capital without sacrificing equity. Flexible payment plans, such as BNPL for B2B, also help manage cash flow more effectively and improve financial stability.

Benefits of B2B BNPL

1. Enhanced Cash Flow Management: One of the primary benefits of B2B BNPL is improved cash flow management. By allowing customers to defer payments, SaaS companies can receive upfront cash, which can be reinvested into growth initiatives. This flexibility is especially valuable for small and medium-sized businesses (SMBs) that often face cash flow constraints.

2. Increased Sales and Customer Acquisition: Offering flexible payment plans can attract a broader range of customers, including those who might be hesitant to commit to large upfront payments. This can lead to increased sales and higher Average Contract Value (ACV). By lowering the barrier to entry, BNPL enables SaaS companies to expand their customer base and boost revenue.

3. Reduced Churn Rates: Flexible payment options can also reduce churn rates by providing customers with the financial flexibility to continue using the service. This enhances customer satisfaction and loyalty, leading to longer-term relationships and higher Customer Lifetime Value (CLTV).

4. Simplified Sales Process: Integrating BNPL into the sales process streamlines operations and reduces administrative burdens. With a seamless payment solution, sales teams can close deals faster and more efficiently, improving overall productivity.

SaaS Payment Flexibility: Adapting to Customer Needs

1. Customizable Payment Plans: Offering customizable payment plans allows SaaS companies to meet the diverse needs of their customers. By providing options such as monthly, quarterly, or annual payments, businesses can cater to different budgetary constraints and preferences.

2. Improved Financial Predictability: Flexible payment plans provide a more predictable revenue stream, allowing SaaS companies to plan and budget more effectively. This financial stability is crucial for making strategic investments and scaling operations.

3. Competitive Advantage: In a competitive market, offering flexible payment options can differentiate a SaaS company from its competitors. By addressing customer needs and providing convenient payment solutions, businesses can enhance their market positioning and attract more clients.

Non-Dilutive Funding for SaaS: Preserving Ownership and Control

1. Revenue-Based Financing (RBF): Revenue-based financing is an attractive non-dilutive funding option for SaaS companies. In exchange for upfront capital, businesses agree to share a percentage of their future revenues with investors. This model aligns the interests of both parties, as investors are incentivized to support the company's growth and success.

2. Debt Financing: Debt financing, such as loans or lines of credit, provides capital without requiring equity dilution. While this option requires repayment with interest, it allows BNPL SaaS companies to retain full ownership and control of their business.

3. Grants and Subsidies: Various grants and subsidies are available to SaaS companies, particularly those focused on innovation and technology. These funding sources do not require repayment or equity dilution, making them an ideal option for non-dilutive financing.

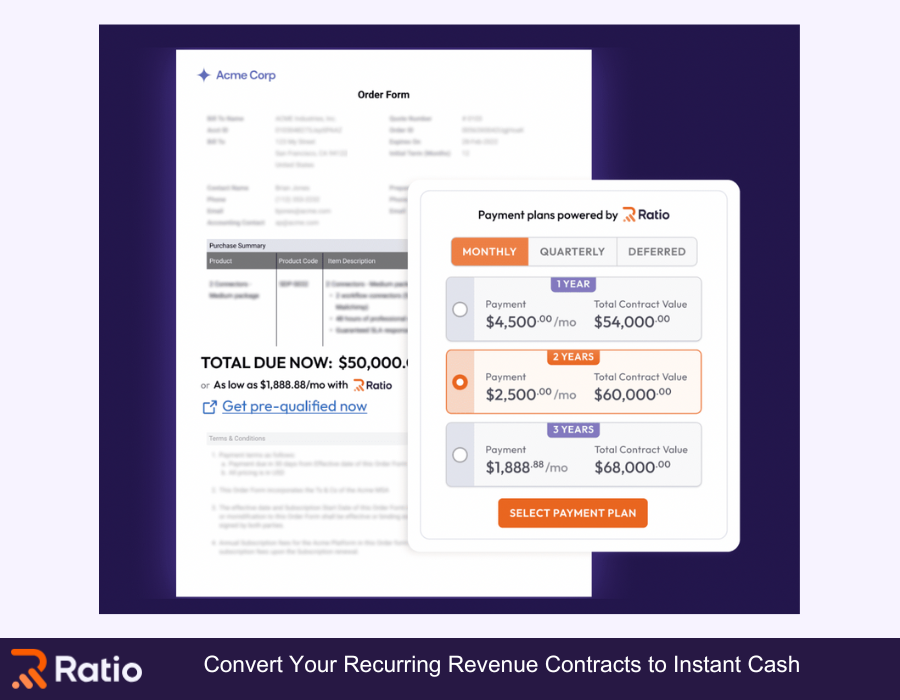

Case Study: Ratio Tech's Success with B2B BNPL

Ratio Tech, a leader in B2B BNPL solutions, has demonstrated the transformative power of flexible payment options. By integrating BNPL into their sales process, Ratio Tech has seen significant improvements in sales velocity and customer satisfaction. As Joe, a senior sales manager at Ratio Tech, explains, “We saw an immediate increase in sales velocity and a reduction in friction during the sales process. Our customers appreciated the flexibility of not having to pay the full amount upfront.”

The success of Ratio Tech highlights the potential of B2B BNPL to drive growth and enhance financial stability for SaaS companies. For more insights and strategies on leveraging BNPL for business growth, visit Ratio Tech’s blog and explore their innovative solutions on their product page.

Conclusion

In conclusion, embracing flexible financing options such as B2B BNPL and non-dilutive funding can significantly benefit SaaS companies. By enhancing cash flow management, increasing sales, and reducing churn rates, these innovative solutions provide a competitive edge in the market. As the SaaS industry continues to evolve, adopting flexible payment plans and exploring non-dilutive funding options will be essential for achieving long-term growth and success.

As the SaaS industry continues to grow and evolve, innovative financing options are becoming increasingly essential for companies looking to scale and remain competitive. Traditional funding methods, such as venture capital, often come with the drawback of diluting ownership. However, new approaches like Buy Now, Pay Later (BNPL) for B2B transactions and other non-dilutive funding…

Recent Posts

- Schneider Painting: Premier Painters in Fayetteville, AR, and NWA

- Certified Safety Experts: Empowering Safer Work Environments with Comprehensive Training and Certifications

- Vinyl Siding Richmond: Elevating Homes with Premier Siding Solutions in Richmond, VA

- Epoxy Bros LLC Expands Premier Residential Epoxy Services to St. Johns County and Brevard County

- Cleanstone Construction: Transforming Outdoor Spaces with Exceptional Decks and Porches in Richmond, VA